May Sonoma County Real Estate Update

“Price is what you pay. Value is what you get.”

– Warren Buffett

I’ve been pondering this idea lately. The importance of value over price in decision-making.

Do I buy organic because it’s better for me, even though it’s more expensive? Do I invest in key wardrobe pieces that will stand the test of time or opt for the Amazon version?

We currently live in a price-sensitive world where even those who are considered “wealthy” are having to contemplate this choice due to the rising cost of living. It’s at the core of every purchase we make… including our homes.

May flowers are blooming & so is the Sonoma County market

Can you believe it’s almost summer? Along with the flowers and sunshine, the dynamics of our housing market are changing yet again. There is a subtle but important shift in the market this month. See below for more insight.

Kids are getting out of school and will be home for summer break. Meanwhile, teenagers are leaving home to get ready for college. Needless to say, May and June are months of adjustment. So, should your home adjust as well?

Spring Real Estate, NAR & Sonoma County Fun!

There’s a lot to cover with you this week! Let’s dive right in…

I first want to address the elephant in the room: The National Association of Realtors (NAR).

You’ve probably seen the headlines or maybe watched a video circulating on social media about the $418 million dollar lawsuit settlement this month.

Everyone is talking about it, and I have a few thoughts (and opinions) too.

Treehouses, Puppies & The Spring Market!

Spring is here, I can feel it! Wildflowers are making an appearance in our vineyards and gardens and the housing market is heating up.

Fun Fact: 40% of home purchases happen between March through May.

Why? Good weather, an abundance of sellers, and timing (most people want to be in a new home before the school year starts).

Welcome to Early Spring in Wine Country!

The first signs of spring have arrived! This is one of my favorite seasons in Sonoma County. Everywhere you look you can see yellow mustard popping up in the vineyards and other spring flowers beginning to bloom.

Yellow is often associated with optimism and joy and that’s exactly what we could all use a little more of in 2024… including in the real estate world!

Holiday Fun in Sonoma County

The holiday season is here in Sonoma County, and with it, the expected quieting of real estate activity as the focus shifts to holiday gatherings, seeing friends and family, and warm celebrations.

Buying or selling a property may not be top of mind for you with all the other festivities this month, but there is something to be said for listing your home during the quiet of winter: there’s less competition on the market, and buyers who are still actively looking are serious buyers.

Homes that go into contract during the second half of December typically wouldn’t close escrow until sometime in January—what a way to kick off 2024! Food for thought, along with all the other holiday delicacies.

Should You “Wait & See”? 📉

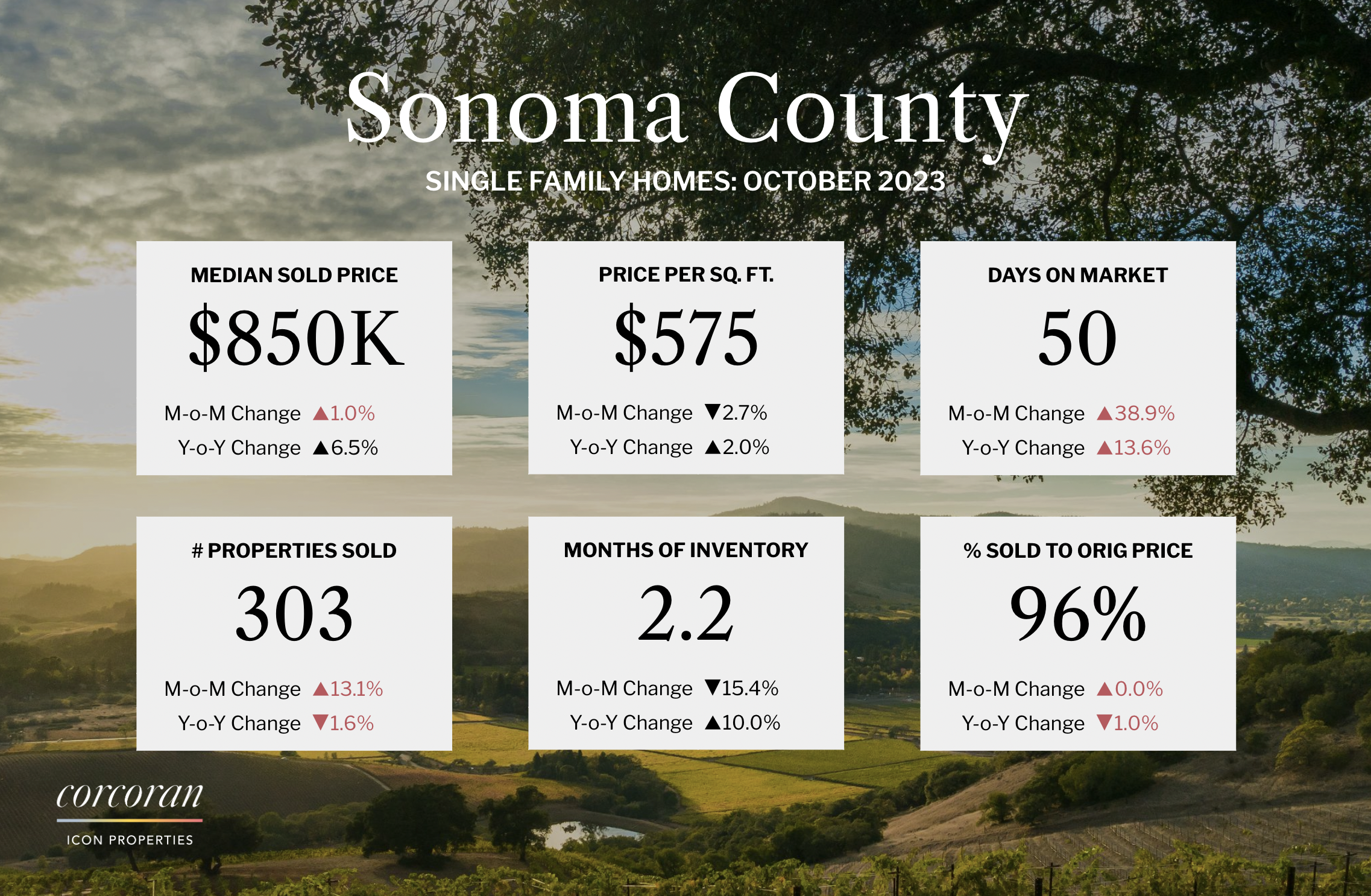

Autumn is upon us and we’re in the midst of the post-Labor Day / pre-holidays bump in the real estate market – a window of time that’s coming to a close soon!

One of the questions I’ve been getting a lot lately is, “Should I wait and see what interest rates do next year or jump in the market now?”

A valid question for both buyers and sellers.

Before sharing my perspective, I think it’s wise to look at what’s happening in the market.

🍂 Fresh Eggs, Wine Walks & Fall Fun!

It’s October in Sonoma County, and I’m ready for all things fall! 🍂

From cooling temps and changing leaves, to cozy sweaters and decorating for the holidays —I can’t wait! Can you?

Fall is the world’s way of embracing change and often prompts us to reconsider our own routine and home life. Maybe that means adopting a new healthy habit, getting up earlier to make the most of shorter days, or even a change of address.

July Sonoma County Market Stats, Happy Hour & End-Of Summer Fun!

Where did summer go?

We’re officially in that in-between season of summer fun and fall productivity. I don’t know about you, but I’d personally like a few more days of beach, pool and sunshine! But alas, the season is changing, and so is the Sonoma County housing market!

This year, real estate has seen some crazy twists and turns. From roller coaster interest rates, inventory shortages to fluctuating pricing, and a two-week MLS outage, what have we not seen?

Summer Fun & Things To Do This July in Sonoma County

Welcome to July! Can you believe we’re already in the thick of summer in Sonoma County? I’m loving the blue skies and a healthy dose of sunshine, however the summer months can be a busy time.

Our calendars fill up fast with vacation plans, a plethora of new outdoor events to attend and additional time spent working on the house and in the garden.

It’s important to remember to slow down and literally “smell the roses.” Enjoy the longer days, savor a glass of wine and carve out time to reflect on our goals for the year.

How are we progressing? How do we feel? What’s working and what’s not?

If real estate is a goal that’s on your mind, you’re not alone! This year has been a change of pace for both buyers and sellers. Many have put their plans on hold as they wait out the interest rate hikes and rising home prices.

Keep reading below for more on how our housing market is performing and a list of ways to enjoy summer in Sonoma County!