Mortgage rates are finally down! 📉

“Every move signifies a fresh start, a chance to decorate your life with new experiences and make new memories in a new place.”

Mortgage rates have dropped this month to their lowest level in 15 months in anticipation of growing consensus that the Fed will cut rates soon. Maybe it’s finally time to make a move?

The average rate on 30-year fixed-rate mortgages dropped to 6.44%. We’re not expecting to see those once-in-a-blue-moon low rates of 2021, but compared to the high just under 8% last fall, seeing rates nudging under 6.5% again is a sight for sore eyes.

What will all this mean for the fall real estate market?

When rates drop, buyers may get more active in their home search, increasing competition. That’ll coincide with the seasonal uptick we often see in the fall.

The fall market is the time sandwiched between Labor Day and Thanksgiving. Summer is winding down, but the holidays haven’t yet arrived, so we often see a bit of market heat during this time period. Combined with the lower interest rates, that could set the tone for a busy fall.

Let’s take a look at what’s happening with sales activity in the local market…

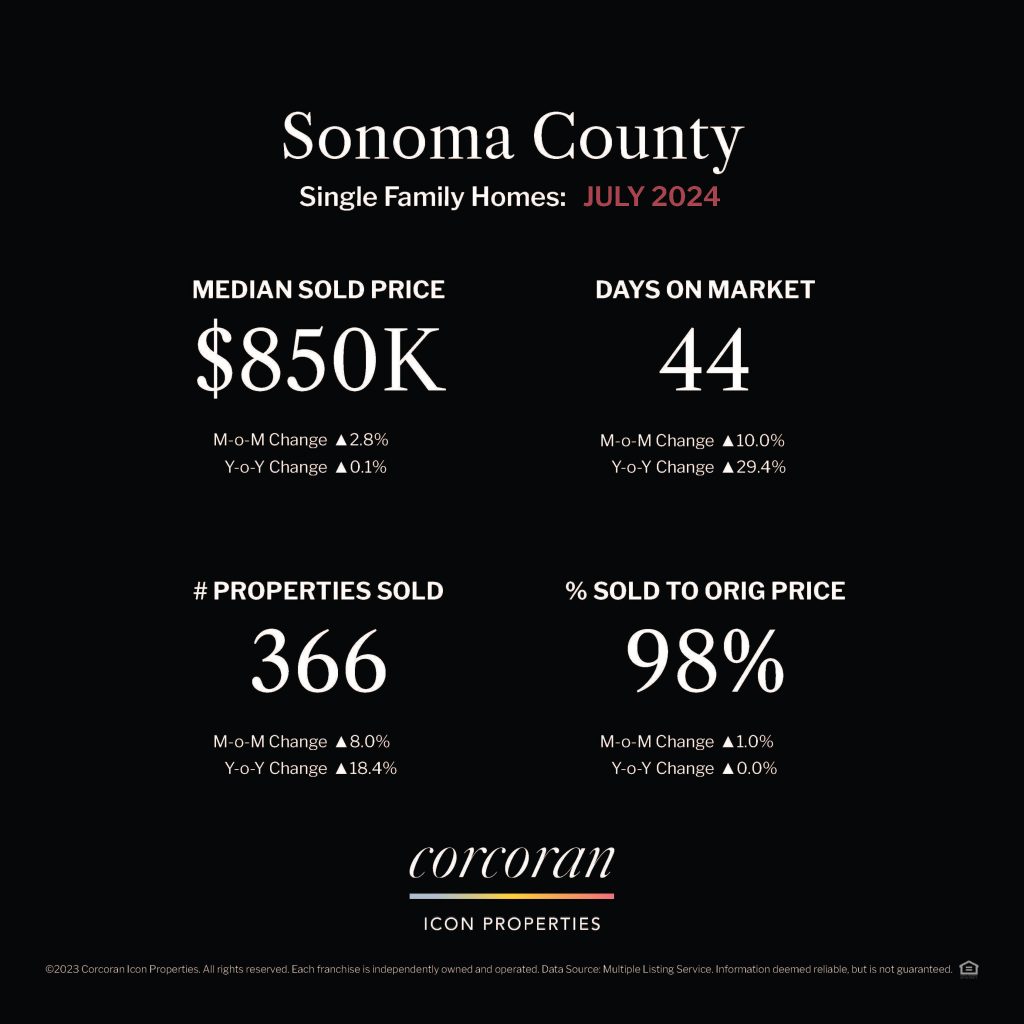

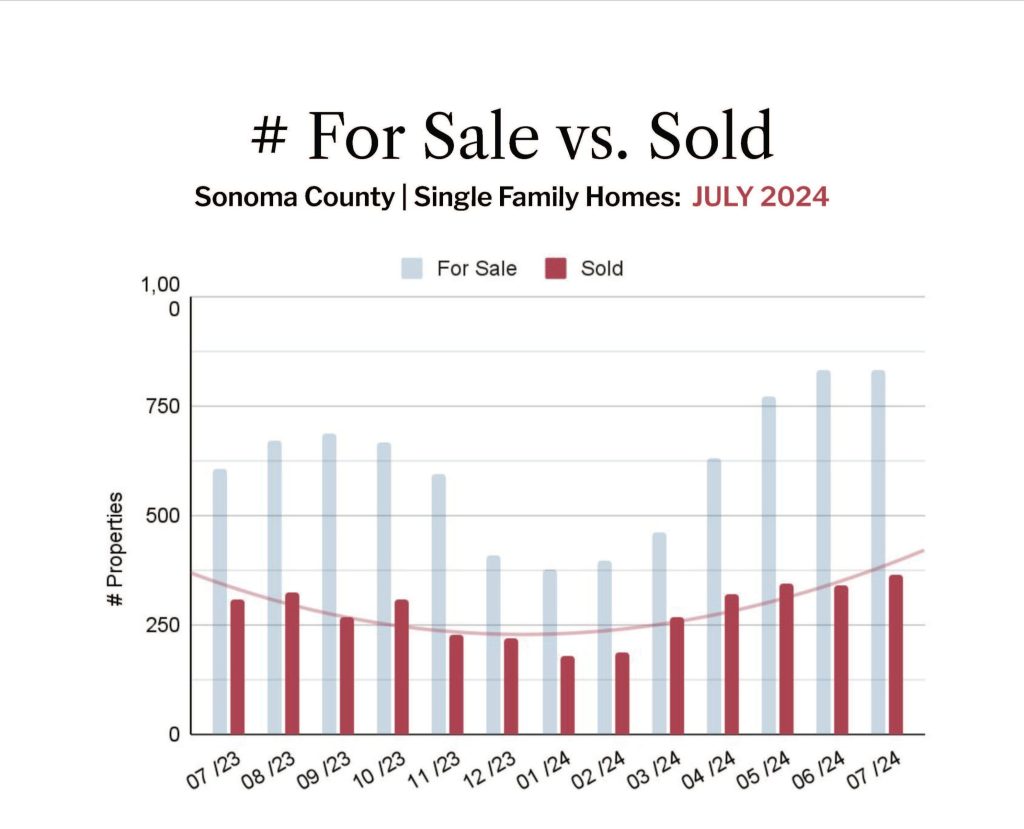

Compared to the same period last year, the median sales price for single-family homes in Sonoma County increased 0.1% to $850K; condos/townhomes decreased 8.3% to $433K.

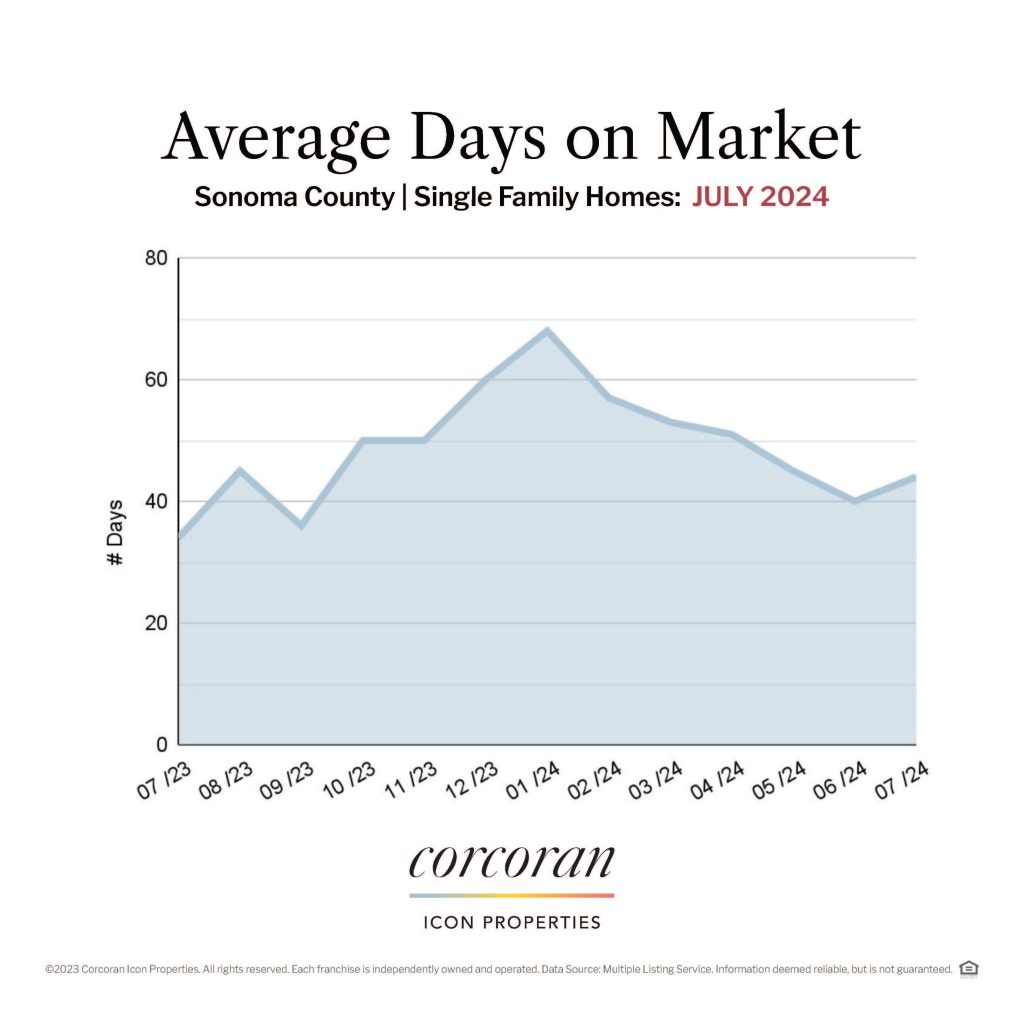

➡ Average days on market were seasonally slower at 44 days for single-family homes and 49 days for condos/townhomes.

➡ The number of residential properties sold was 394, moderately up compared to the same period last year.

➡ Inventory dropped 8% from the previous month to 2.3 months, but was up 15% year-over-year.

Click here to read the full Sonoma County July Market Report.

People move for all kinds of reasons: upsizing, downsizing, new jobs, etc. Moves happen not because the price is right or the market is right but because the time is right on a personal level. Real estate agents don’t have a magic wand to conjure the perfect home or to decrease rates, but we can help you find the best opportunities in any market. Let’s talk about how we can make the most of it for you.

pambuda@gmail.com | (707) 480-4142

Does the time to buy real estate ever feel perfect? The answer is – not usually. Right now, we face a number of challenges in the housing market. So many people have responded by hitting the pause button. Well, if history has taught us anything, waiting to buy real estate has been a poor strategy.

For example, in 1971 the interest rates were about 7.5%. Many people decided to wait until the interest rates dropped. If you’d have been one of those people, you wouldn’t have purchased until 1993.

You’d have rented for 22 years while you waited for rates to come down. In the meantime, house values quadrupled. The key principle is ‘don’t wait to buy real estate; buy real estate and wait.’