It’s finally happening – mortgage rates dip below 6%!

The end of the summer season is bringing some sunnier news on mortgage rates. ☀️

We were hoping to see rates on the 30-year mortgage dip below 6.5% this month, but we got something even better. The 30-year mortgage rate has fallen again, now reaching a 19-month low at 6.05%.

In some areas across the country (California, Florida, New Jersey, New York, and Utah), it’s dropped to right at or slightly below the 6% mark. That’s a full percentage point below July 2024 and nearly two percentage points below last year’s peak in October 2023.

All eyes are on the Fed’s upcoming meeting, where many economists anticipate a rate cut. This could relieve many buyers on the sidelines (sellers, too) by giving them more buying power. However, it could also create more competition in the typically robust fall market.

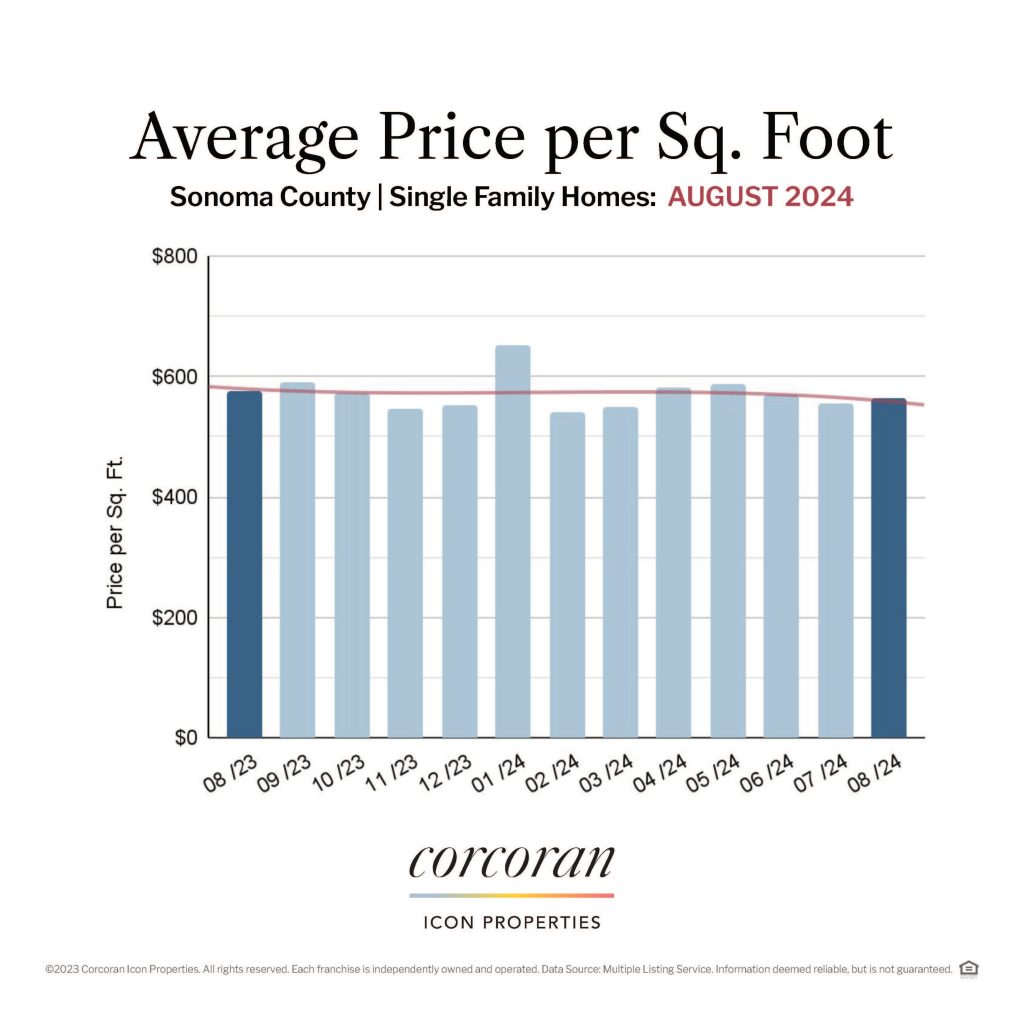

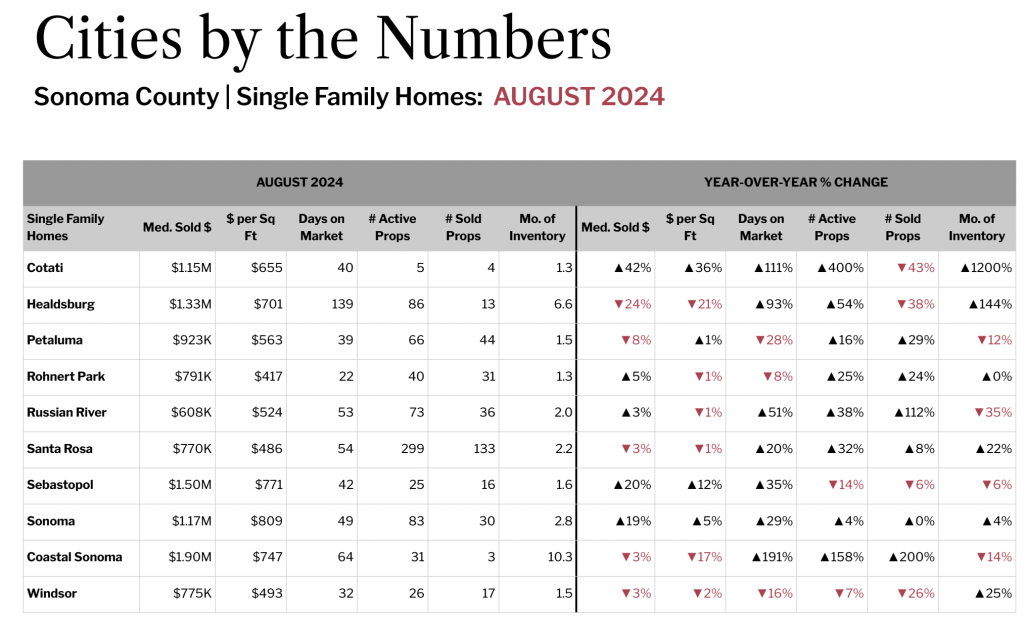

Beyond rates, let’s take a look at what’s happening with home prices, sales activity, and inventory in our local market…

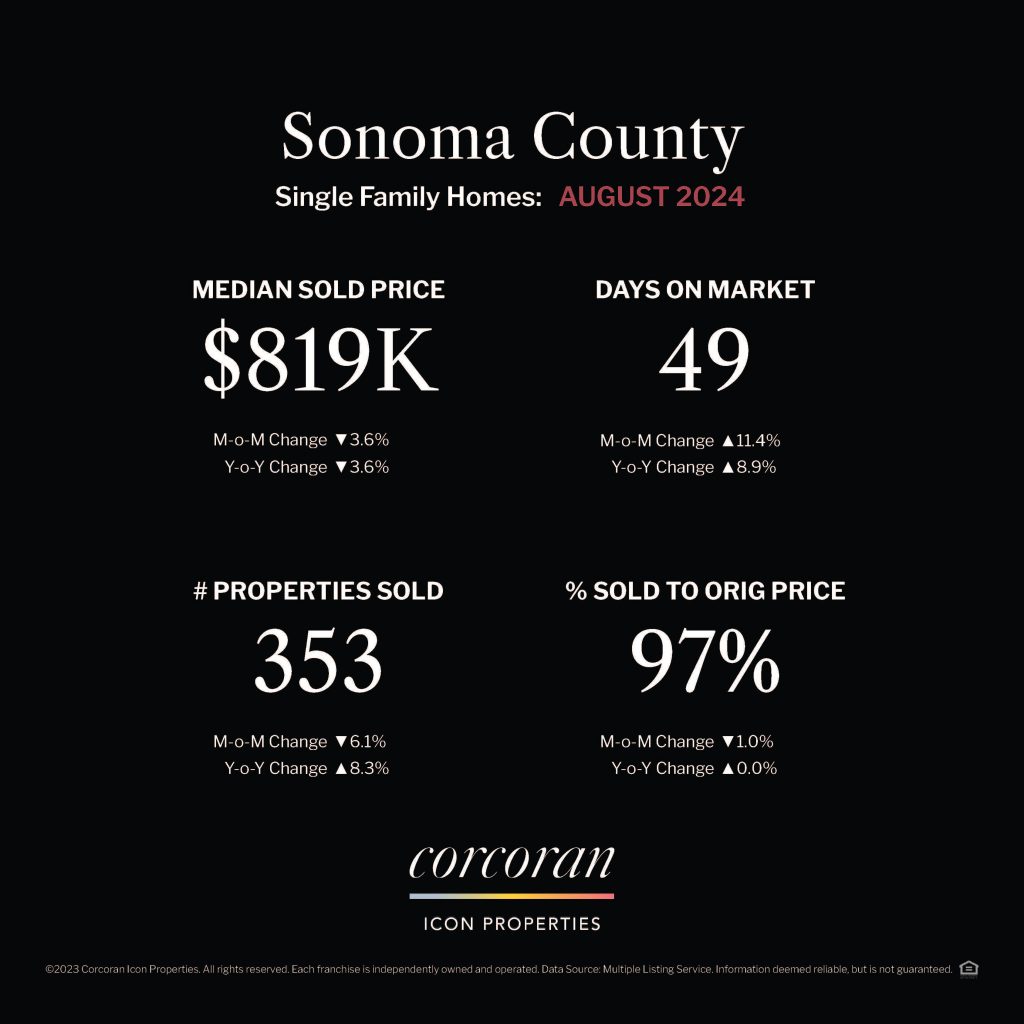

Compared to the same period last year, the Sonoma County median sales price for single-family homes decreased 3.6% to $819K; condos/townhomes decreased 4.5% to $425K.

➡ Average days on market was still quite low at 49 days for single-family homes and 52 days for condos/townhomes.

➡ The number of residential properties sold was 386, moderately up compared to the same period last year.

➡ Inventory increased 9.1% from the previous month and 14.3% from this time last year to 2.4 months. A trend we’ve seen over the past few months.

Click here to read the full Sonoma County August Market Report.

People move for all kinds of reasons: upsizing, downsizing, new jobs, etc. Moves happen not because the price is right or the market is right but because the time is right on a personal level. Real estate agents don’t have a magic wand to conjure the perfect home or to decrease rates, but we can help you find the best opportunities in any market. Let’s talk about how we can make the most of it for you.

pambuda@gmail.com | (707) 480-4142