Has the Sonoma County Market Peaked for the Year?

The summer season is here, and vacationing is more on the mind than moving.

Of course, some aren’t making home moves because they’re still waiting for a mortgage rate drop. Though some economists, such as NAR’s Chief Economist Lawrence Yun, are predicting that they will come down a bit by year’s end, they won’t come close to the 3% that occurred during the once-in-a-lifetime pandemic event.

It’s important to remember that rates affect competition. With some buyers on the sidelines right now, there may be a little less competition for the home you want.

When rates drop, more buyers could jump into the pool and thus more competition.

With that in mind, let’s take a look at what’s happening with inventory and prices locally…

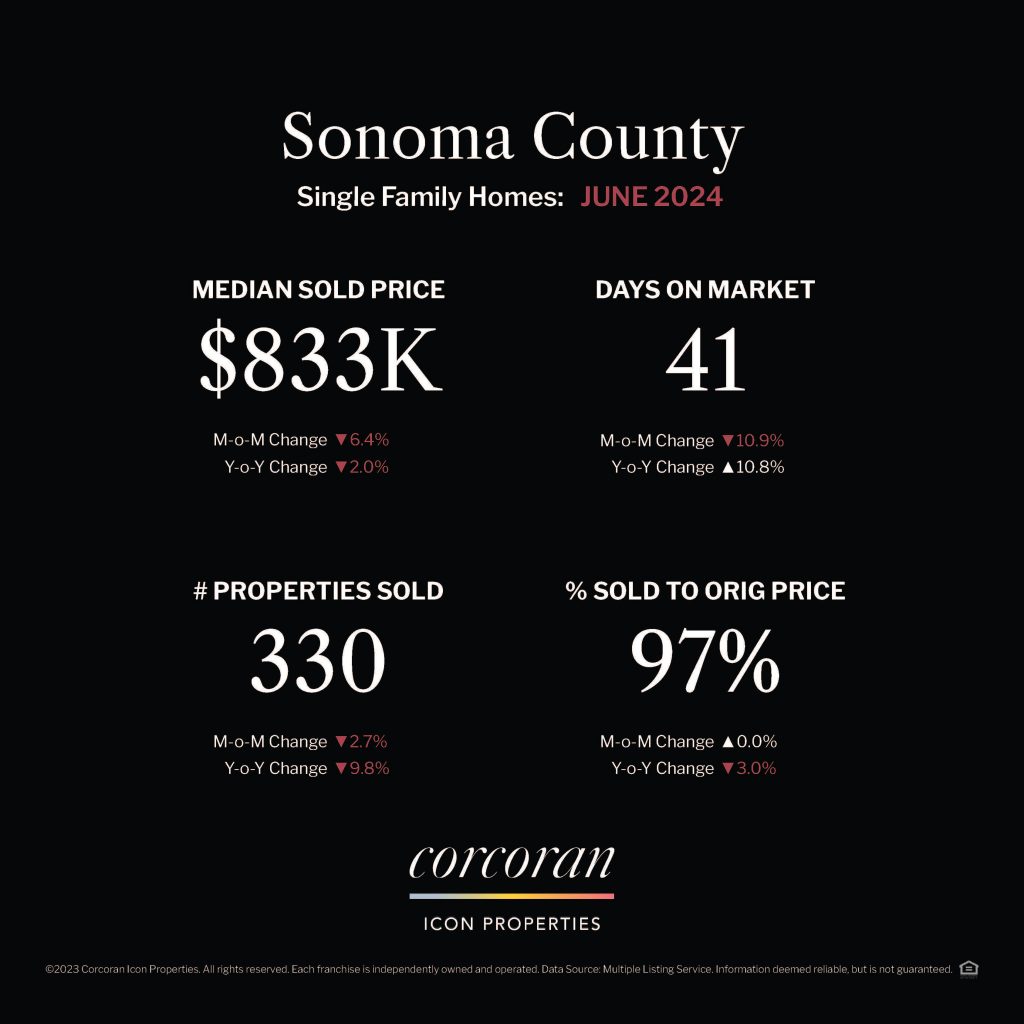

Compared to the same period last year, the median sales price in Sonoma County for single-family homes decreased 2.0% to $833K; condos/townhomes increased 2.8% to $475K.

➡ Average Days on market increased 10.8% to 41 days versus last year reflecting that some properties took longer to sell this year.

➡ The number of single-family homes sold declined by nearly 10% year-over-year to 330 units.

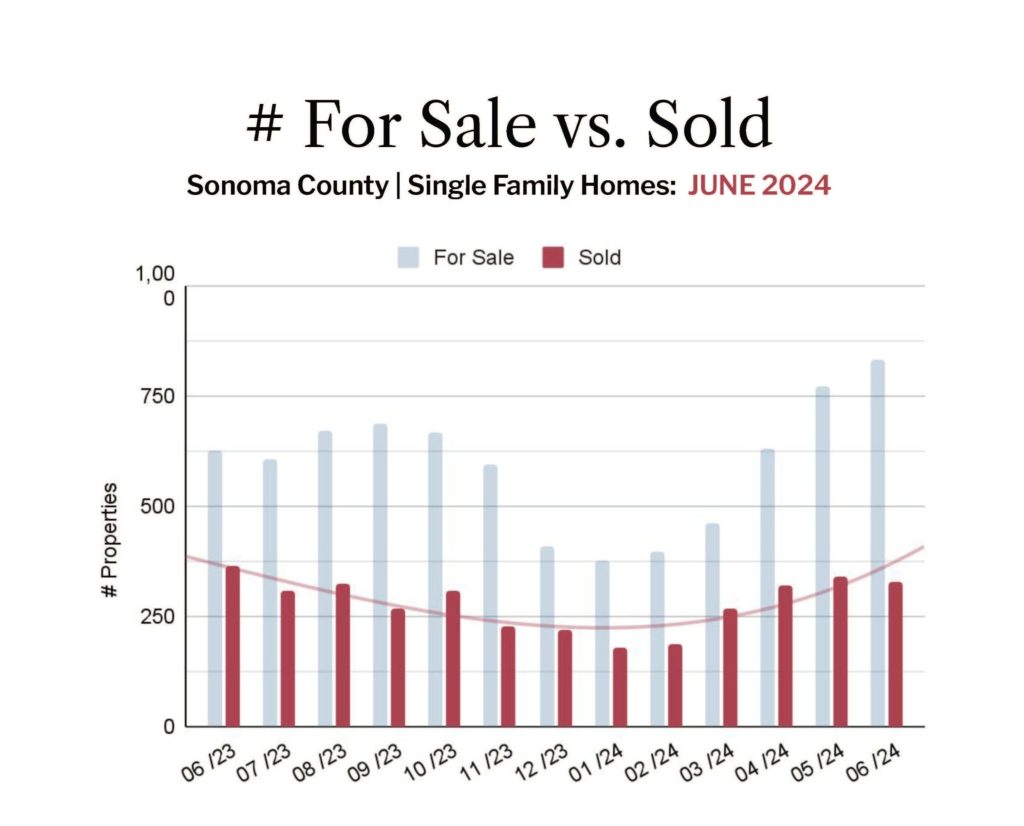

➡ Months Supply of Inventory increased significantly (47.1%) year over year.

People move for all kinds of reasons: upsizing, downsizing, new jobs, etc. Moves happen not because the price is right or the market is right but because the time is right on a personal level. Real estate agents don’t have a magic wand to conjure the perfect home or to decrease rates, but we can help you find the best opportunities in any market. Let’s talk about how we can make the most of it for you.

Homeownership has many benefits: stability, security and the freedom to make the space your own. It also offers financial advantages — not only will you get tax benefits, building equity in your home is like a ready-made savings plan.

For those of you looking to change your home space, whether upsizing or downsizing, home equity is the highest it’s ever been. The average homeowner with a mortgage is sitting on $299,000 in equity. And almost 40% of homes are owned free and clear!

Now might be a great time to tap into that equity and buy the house you really want. Having a paid off, or almost paid off mortgage might allow you to pay all-cash or only take out a smaller mortgage – which opens a lot of options.

Click here to read the full Sonoma County June Market Report.