Treehouses, Puppies & The Spring Market!

Spring is here, I can feel it! Wildflowers are making an appearance in our vineyards and gardens and the housing market is heating up.

Fun Fact: 40% of home purchases happen between March through May.

Why? Good weather, an abundance of sellers, and timing (most people want to be in a new home before the school year starts).

Welcome to Early Spring in Wine Country!

The first signs of spring have arrived! This is one of my favorite seasons in Sonoma County. Everywhere you look you can see yellow mustard popping up in the vineyards and other spring flowers beginning to bloom.

Yellow is often associated with optimism and joy and that’s exactly what we could all use a little more of in 2024… including in the real estate world!

Holiday Fun in Sonoma County

The holiday season is here in Sonoma County, and with it, the expected quieting of real estate activity as the focus shifts to holiday gatherings, seeing friends and family, and warm celebrations.

Buying or selling a property may not be top of mind for you with all the other festivities this month, but there is something to be said for listing your home during the quiet of winter: there’s less competition on the market, and buyers who are still actively looking are serious buyers.

Homes that go into contract during the second half of December typically wouldn’t close escrow until sometime in January—what a way to kick off 2024! Food for thought, along with all the other holiday delicacies.

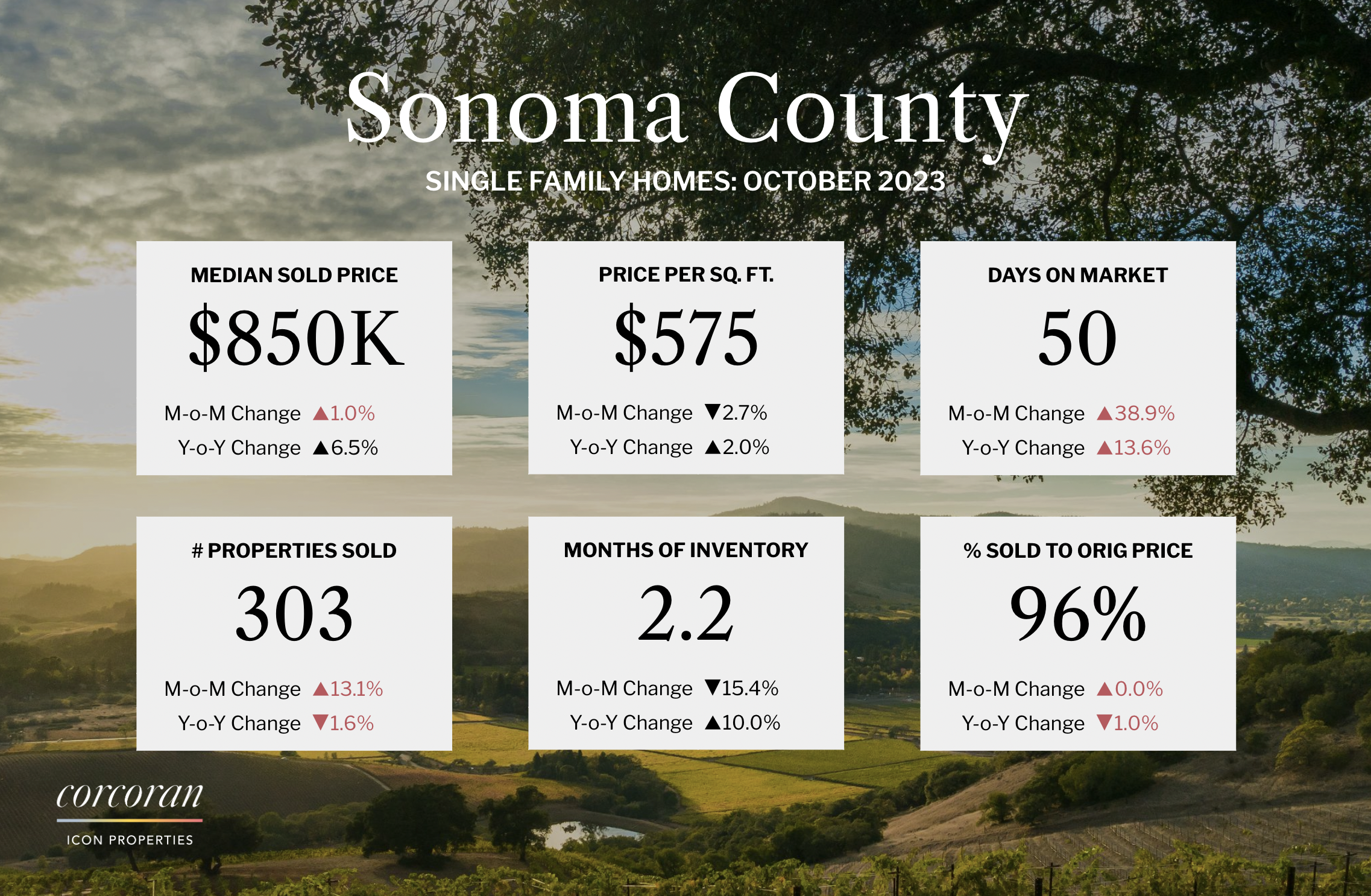

Should You “Wait & See”? 📉

Autumn is upon us and we’re in the midst of the post-Labor Day / pre-holidays bump in the real estate market – a window of time that’s coming to a close soon!

One of the questions I’ve been getting a lot lately is, “Should I wait and see what interest rates do next year or jump in the market now?”

A valid question for both buyers and sellers.

Before sharing my perspective, I think it’s wise to look at what’s happening in the market.

🍂 Fresh Eggs, Wine Walks & Fall Fun!

It’s October in Sonoma County, and I’m ready for all things fall! 🍂

From cooling temps and changing leaves, to cozy sweaters and decorating for the holidays —I can’t wait! Can you?

Fall is the world’s way of embracing change and often prompts us to reconsider our own routine and home life. Maybe that means adopting a new healthy habit, getting up earlier to make the most of shorter days, or even a change of address.

July Sonoma County Market Stats, Happy Hour & End-Of Summer Fun!

Where did summer go?

We’re officially in that in-between season of summer fun and fall productivity. I don’t know about you, but I’d personally like a few more days of beach, pool and sunshine! But alas, the season is changing, and so is the Sonoma County housing market!

This year, real estate has seen some crazy twists and turns. From roller coaster interest rates, inventory shortages to fluctuating pricing, and a two-week MLS outage, what have we not seen?

Summer Fun & Things To Do This July in Sonoma County

Welcome to July! Can you believe we’re already in the thick of summer in Sonoma County? I’m loving the blue skies and a healthy dose of sunshine, however the summer months can be a busy time.

Our calendars fill up fast with vacation plans, a plethora of new outdoor events to attend and additional time spent working on the house and in the garden.

It’s important to remember to slow down and literally “smell the roses.” Enjoy the longer days, savor a glass of wine and carve out time to reflect on our goals for the year.

How are we progressing? How do we feel? What’s working and what’s not?

If real estate is a goal that’s on your mind, you’re not alone! This year has been a change of pace for both buyers and sellers. Many have put their plans on hold as they wait out the interest rate hikes and rising home prices.

Keep reading below for more on how our housing market is performing and a list of ways to enjoy summer in Sonoma County!

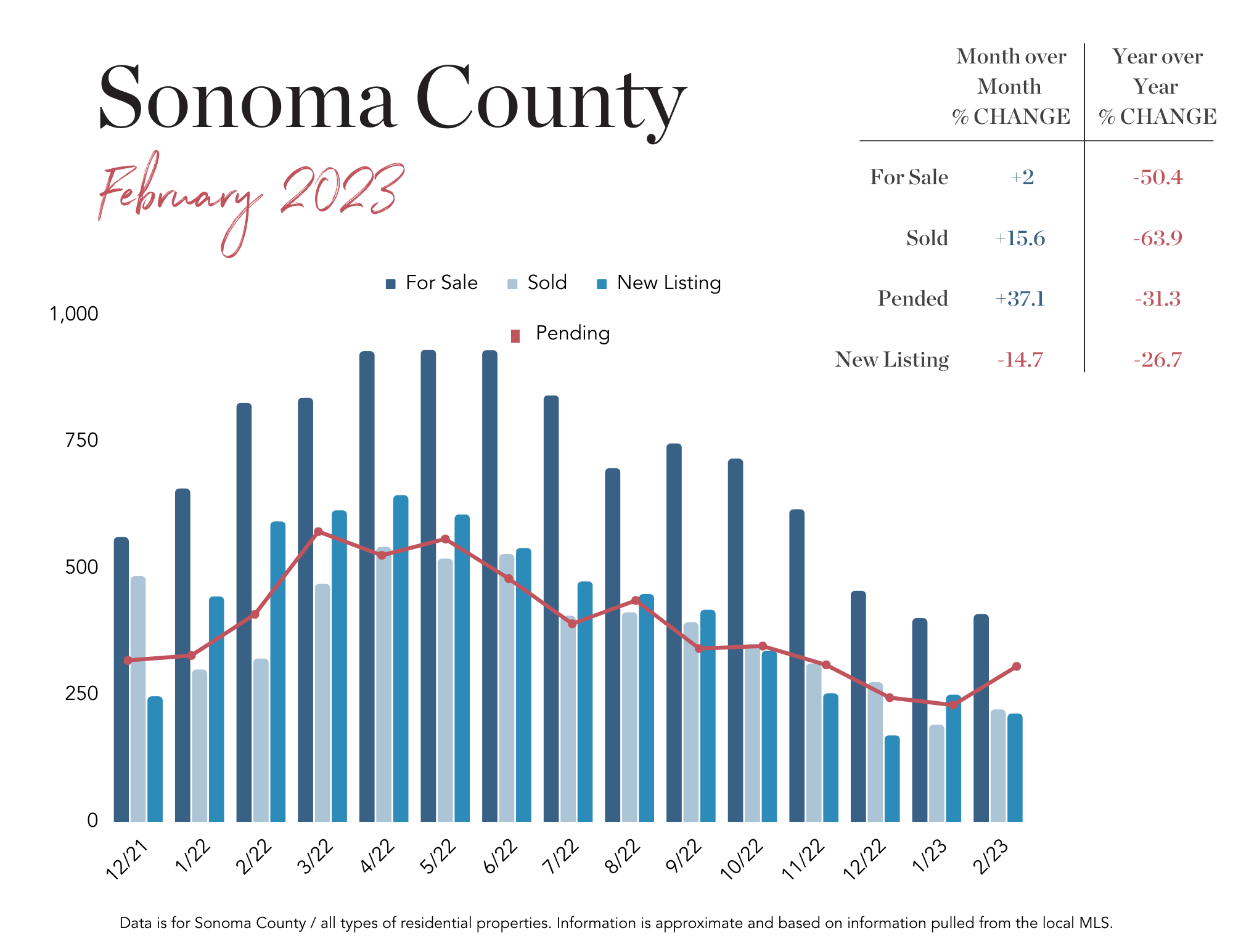

February 2023 Sonoma County Market Update

The spring housing market is heating up! With inventory in the North Bay down 50 percent year-over-year, we are continuing to see multiple offer situations and sales prices going over asking. While it’s usually not at the same rate or increase that we saw over the last few years, it does tell us that buyers have entered back into the market and sticker shock of the sharp rise in interest rates has settled a bit.

Sonoma County Spring Housing Market Predictions

One thing I love about this month, is the mustard, which pops up in our vineyards towards the end of winter. These beautiful blooms are a welcome sign that spring is right around the corner and with all the rain we are getting it is stunning!

Speaking of spring, the real estate market in Sonoma County is starting to heat up! Rising interest rates, combined with high homes prices led to a slow fall and winter season. A stark contrast from the hot market we had leading up to summer 2022.

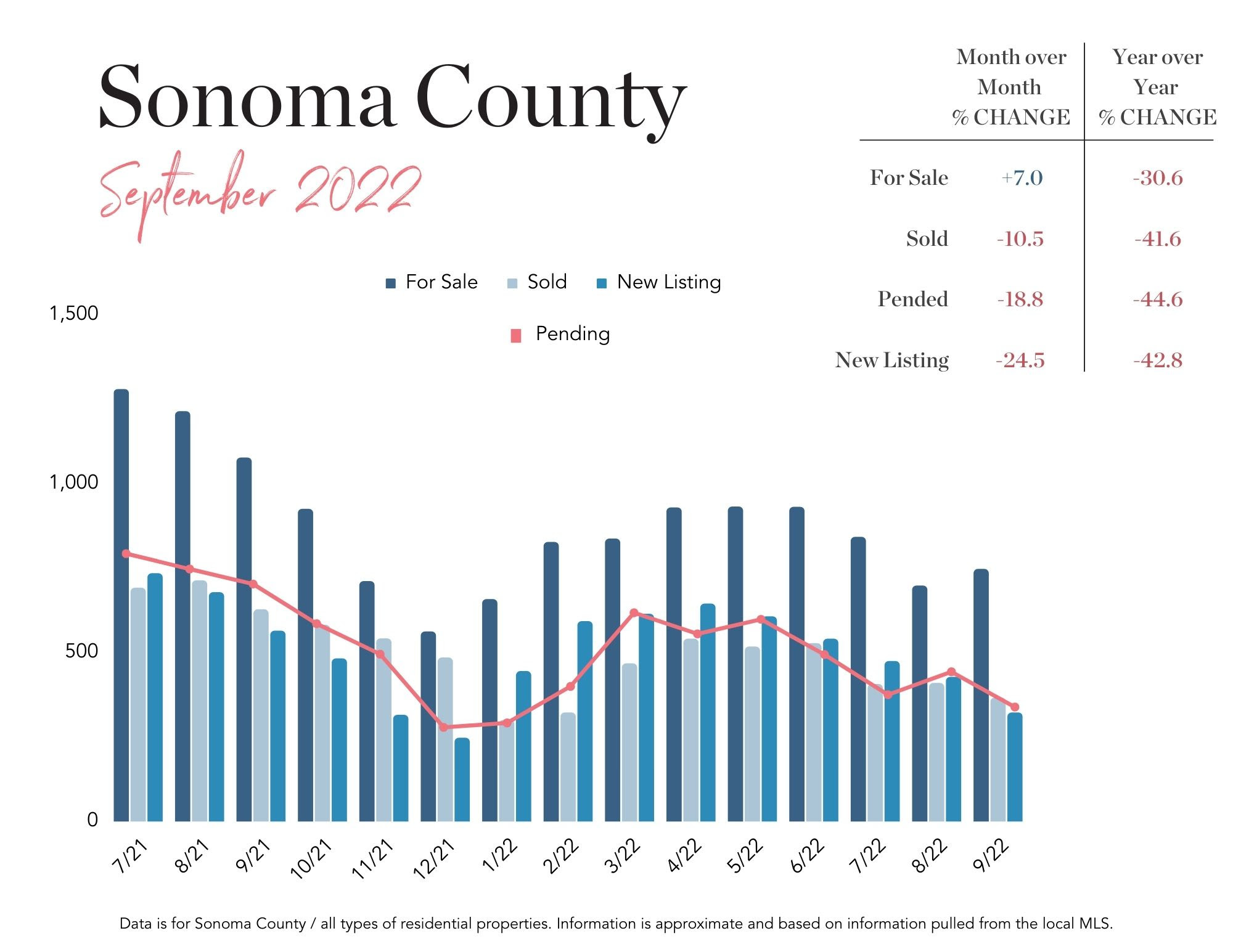

Sonoma County Real Estate Market Update: What Happened in September 2022

Market Talk It’s officially fall and inventory is on the rise around the country. View the full report here: September 2022 Sonoma County Market Update. We are seeing the typical seasonal bump in new listings in the Wine Country. However, rising interest rates affect some would-be sellers too. They are holding off putting their homes on the market since they would be doubling their interest rate when buying a replacement home unless they purchase cash of course. And, there are still plenty of buyers in the market place searching for homes! Mortgage interest rates are at their highest level in more than 14 years, sales inventory has ticked up a bit but is still historically low, and fear of a looming recession is still a topic of discussion in the media. What we do know is there are still buyers actively shopping for homes, and desirable properties that show well and are priced correctly have been going into contract, in some cases even with multiple offers and well over asking. One recent country property in Sebastopol priced at $2 million sold for $3,150,000! It’s very important that buyers understand there are a number of loan programs out there that can help offset the higher monthly payment at today’s rates, and rates can vary significantly from lender to lender. You want to make sure you shop around and look at all options, from 2-1 rate buy down programs to credit union rates and special institutional lending programs. Be diligent in your research before choosing a lender to work with. And a flashback to earlier years, some sellers may even have mortgages that are assumable at yesterday's low rates. In the past those were typically adjustable mortgages so again it is important to do careful research. Traditionally, markets like this will stabilize, but when that happens and what "stability" looks like is up in the air. Reach out to your trusted real estate professional to help you decide if it makes sense to make a move now or wait! ...